Good bookkeeping is a major criterion that reflects the excellent management of a company. However, for SMEs, this exercise is not always easy to achieve. What is then the bookkeeping? What are the advantages? And what are the alternatives available to SMEs regarding this exercise?

Bookkeeping: What is it?

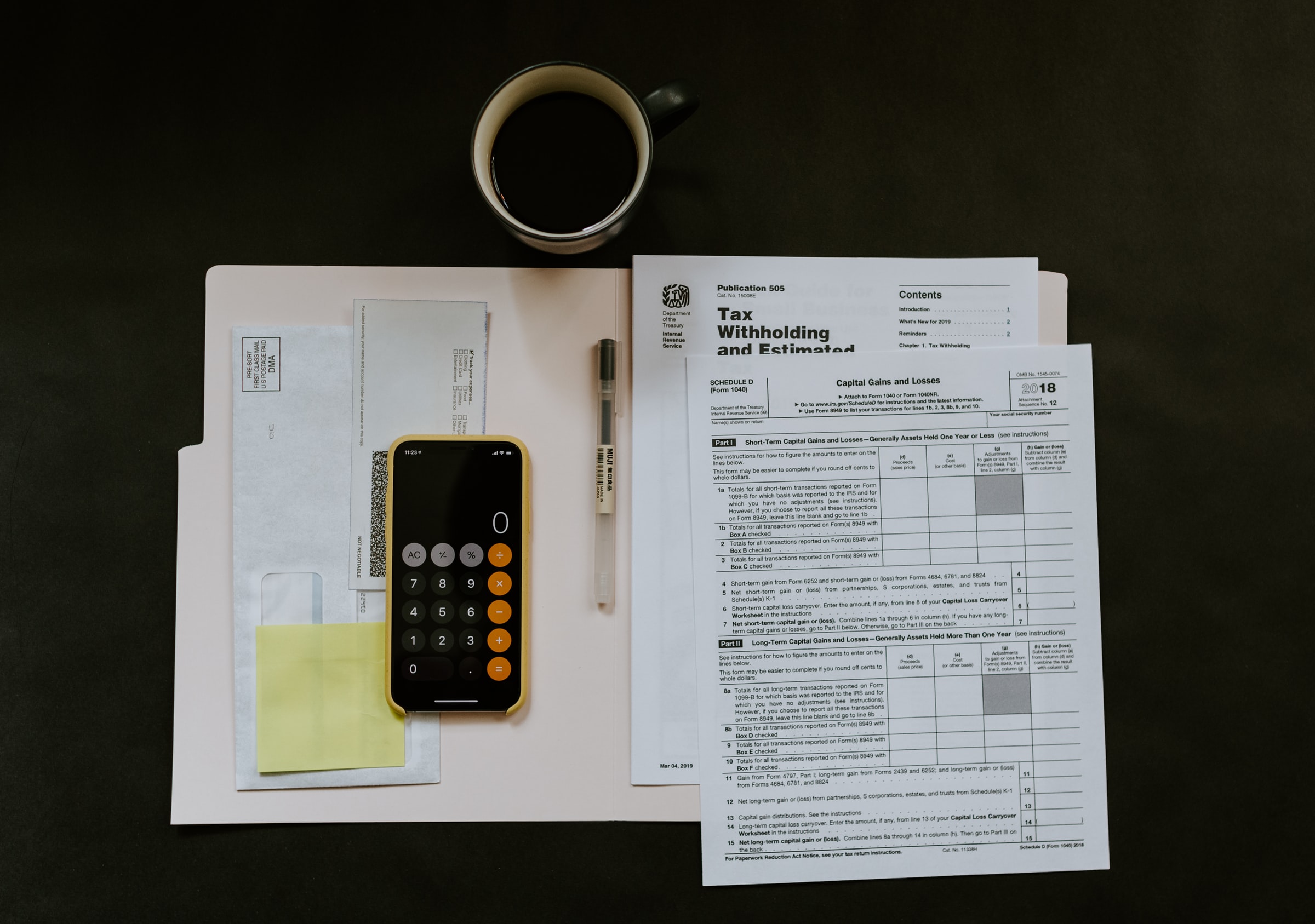

Bookkeeping is the process of keeping track of all the elements that are relevant to the accounting field. It can be purchase invoices, sales invoices, receipts, or any other documents of the kind. Bookkeeping is essential, often trivialized by some business owners who consider it to bring very little added value to the company.

Bookkeeping is an exercise that can be entrusted to a company’s staff. It allows for cleaning up the company’s finances insofar as it is used to justify all the company’s expenses in the smallest details. On the other hand, it allows the company to be in good standing with the tax authorities.

However, for more efficiency and in order to obtain fully transparent points, it is recommended to entrust this task to an external provider. This service provider can be an accredited firm in the field, added to the fact that it must advocate loyalty, rigor, and integrity in all its operations.

To this end, accounting firms are an excellent option for the rigorous maintenance of the books of account, the establishment of annual accounts, and the management of issues related to tax returns and estate accounting.

Bookkeeping: A legal obligation

If many business owners tend to trivialize the issues related to business accounting, it should be noted that it is a mandatory exercise. Moreover, the famous pretext that tends to justify the fact that an SME can do without this exercise does not hold. It should be kept in mind that the accounting obligations of companies vary according to the tax system.

However, the tax authorities require all companies to keep a written record of all transactions. These records will allow the tax authorities to attest to the transparency and accuracy of the company’s tax returns.

Bookkeeping: The advantages

It is important for business owners to consider bookkeeping as an opportunity, not a constraint. First of all, it is important to know that good bookkeeping allows a better allocation of the company’s resources.

Indeed, the books of account contain all the information related to the chain of expenses. Consulting them allows you to quickly identify the most profitable activities and those that should be abandoned. Then, good accountancy management allows reassuring the partners and the investors in the sense that it removes the doubts relative to possible misappropriations.

It should not be forgotten that in the world of finance, the rigorous management of the finances of a company constitutes a major criterion likely to influence its listing on the stock exchange.

Bookkeeping: Accounting outsourcing as a solution for SMEs

It is difficult for SMEs to cope with the various costs of external service providers recruited for bookkeeping in the long term. Therefore, in order to reduce expenses while complying with the requirements of the tax authorities, it is in the best interest of SMEs to resort to accounting outsourcing.

This option, which costs very little, also allows the company to eliminate certain administrative formalities. Better still, it must be emphasized that this approach has been growing considerably in recent years, to the point where software specially adapted for the exercise has been developed.

Sound off in the comments section below and tell us what you want to read next and if you want to read more about accounting.